Author, The Happiest Man in the World: Life Lessons from a Cultural Economist

Roosevelt’s objective seemed simple enough in the beginning. It had worked for his friend John Maynard Keynes in England: use borrowed federal money and tax revenues to buy the vote of the farmers. The redistributed monies would pay above-equilibrium prices for the farmers’ crops and additional subsidies for their unique farming lifestyles. They would be hooked. That was the plan.

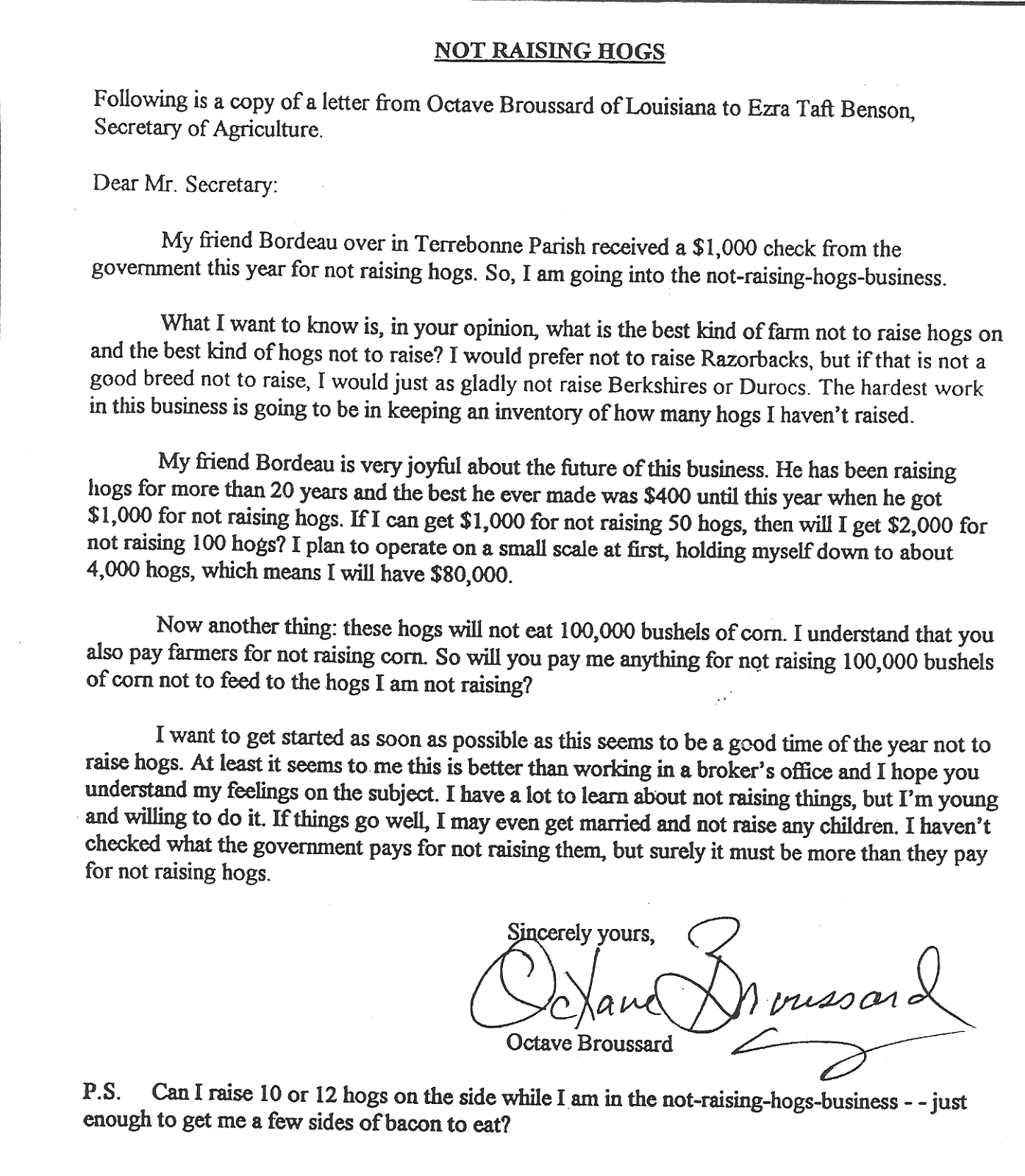

But they failed to see that in the process they were running roughshod over the economic law of supply and demand. The farmers began investing their newly gained subsidies into their operations. That resulted in increased production and surpluses. Even a novice should have known that when there are surpluses the prices naturally go down in order to clear the market. But the government had to artificially keep the prices up to the consumers in order to pay the farmers. They had painted themselves into a corner, but could not admit it for fear of losing the farm votes. That was when they decided to start paying the farmers for not planting crops or raising livestock.

Of course, the matter worsened, and the surpluses kept growing. When it dawned on the planners that they could not manipulate and control the supply side of the equation, they came up with another brilliant idea. If they could get rid of the surpluses then there would be a demand for the products left, and the people would gladly pay the higher price for scarce products. If they played it right, they could dispose of the surpluses and buy yet even more votes through promising more redistribution and subsidies to new groups of voters.

April 20, 1939, the Food Stamp program was launched. “Food Stamps, the latest in Roosevelt’s administration plans to reduce the farm surplus, came off the presses today at the Bureau of Engraving and Printing . . . will be able to cash each one dollar stamp for food worth a dollar and fifty cents.”(1)

Of course I will continue to vote for someone who will just give me food, especially if the one dollar stamp will buy me one dollar and fifty cents worth of my items at the corner grocery store.

Congress frequently revisits the Food Stamp program to enhance it and expand it. In 1974, it was expanded into every state. The 1977 Food Stamp Act made broader accessibility. By 1988, the Act introduced the issuance of a debit type credit card called an Electronic Benefit Transfer (EBT) card. (You may have heard of the recent problem with folks here in Colorado swiping their cards at the ATM machines, then taking the cash to purchase marijuana with the taxpayers’ money.) The program now assists well over thirty million recipients per month. The Food Stamp situation is a whole other issue that is open for your own further research.

After the death of President Roosevelt, the legacy continued. On June 4, 1946, President Harry S. Truman signed the National School Lunch Act into law. Its purpose was to “provide a market for agricultural production . . . and to improve the health and well-being of the nation’s youth . . . the raw materials come from USDA as donated commodities.”(2)

The real story was that the donated commodities from the United States Department of Agriculture had just come from the commandeered tax monies that were used to buy the votes of the farmers who had just raised the commodities.

On July 10, 1954, the Agricultural Trade Development and Assistance Act was signed and became Public Law 480. The law created the Food for Peace program, “to promote the economic stability of American agriculture, to make maximum use of U.S. surplus agricultural products.”

The politicians could not cover the funds used to procure the support and votes of the farmers by trying to curb the supply of the expanding surpluses, so it was necessary to create a demand for the commodities by giving the farm products to those whose votes could additionally be procured.

One of the more recent endeavors of the U.S. Department of Agriculture to manipulate the demand for the government’s surplus crops was the production of gasohol, a blend of gasoline and alcohol (ethanol) made from grain. Additionally, biodiesel, a fuel made from soybean oil and other vegetable oils, has been greatly subsidized in another effort toward demand enhancement.

Is it any wonder that the corporate and private exploration and development process of our own natural resources of oil has been so bitterly opposed? Why is the Federal Government tinkering in all of this?

I think I hear a voice of sanity and reason from somewhere hollering, “stop, Stop, and STOP all this tragic silliness. Why are we paying billions of dollars each year in individual subsidies to farmers, plus billions of dollars in above-equilibrium crop prices, and billions of dollars in administration costs to run a program that we are told is for our own good and we should be ashamed of ourselves for questioning any part of it? For all these expenditures we receive the privilege to pay at least two to three times the normal market price for such commodities as milk and sugar at the grocery store today, plus the privilege to pay additional billions in tax dollars on April 15th each year for what? . . . just for the securing of a vote that brings with it entitlement and power to promote and enact such waste and violation of public trust? What price greedy power and control?” Of course, that voice is ruckus and radical! Pay no heed.

There is already a simple solution to the Farm Policy problem that has already been set into motion and is today available. It is called free enterprise. There is no need for the Gosplan gurus to try to figure it all out with acreage allotments, long division, and stubby pencils.

Let the politicians earn their own votes on a platform of creativity, expansion, and production rather than manipulation, taxation, and redistribution. Wealth only comes through growth and economic production, not redistribution. Redistribution constricts, production expands. Let the farmers decide for themselves what they want to grow and to whomever they wish to sell. If they want to sell their crop at a discount to hot lunch programs, or even donate them of their own goodwill, then let them. Family farmers are very intelligent, caring, and industrious businessmen.

If their personal research tells them that the production of rice or oats will be short next year because of the floods caused by late snow melt or excess rain, let them grow those scarce crops on their own land and live with the expectation of abundant monetary reward because they took the risk to change their regular growing program to take advantage of the coming demand. If they mess up and miscalculate and fail to reap their expected return, they can adjust their crop choice the next year and be the wiser for it in the years to come. But if they make a good decision and they are rewarded handsomely, then they should be respected for being a creative part of solving real problems with their own investigation and initiative.

The free market will send immediate signals and distribute necessary information for all parties to make good decisions as they freely choose what is best for them. The results of all those free choices in the market will bring about the best good for the greatest number of people. Greed and manipulation of centralized economic systems, based on the concept of governmental redistribution, simply cripple creative efforts of the constituents and steal the justified wealth of nations. How a nation handles the concept of free enterprise, with its economic and cultural freedom to make and pursue individual choices, is the determining factor why some nations are poor and some nations are wealthy.

Global transformation takes place at the intersection of culture and economics.

Next Week: Recent Farm Financial Philosophy

(Research ideas from Dr. Jackson’s new writing project on Cultural Economics)

© Dr. James W. Jackson

Permissions granted by Winston-Crown Publishing House

Dr. James W. Jackson often describes himself as "The Happiest Man in the World." A successful businessman, award-winning author and humanitarian, Jackson is also a renowned Cultural Economist and international consultant, helping organizations and governments to apply sound economic principals to the transformation of culture so that everyone is "better off."

Dr. James W. Jackson often describes himself as "The Happiest Man in the World." A successful businessman, award-winning author and humanitarian, Jackson is also a renowned Cultural Economist and international consultant, helping organizations and governments to apply sound economic principals to the transformation of culture so that everyone is "better off."As the founder of Project C.U.R.E., Dr. Jackson traveled to more than one hundred fifty countries assessing healthcare facilities, meeting with government leaders and "delivering health and hope" in the form of medical supplies and equipment to the world's most needy people. Literally thousands of people are alive today as a direct result of the tireless efforts of Project C.U.R.E.'s staff, volunteers and Dr. Jackson.

To contact Dr. Jackson, or to book him for an interview or speaking engagement: press@winstoncrown.com